Taken from my lectures as a Teachinig Fellow in International Law at Università degli Studi “Link”, these reflections highlight how State sovereignty and International Law are profoundly influenced by globalization, economic integration and digital technologies, raising fundamental questions about global governance, State autonomy and the adaptation of legal structures to new economic and technological realities.

Part II

International Law and economics

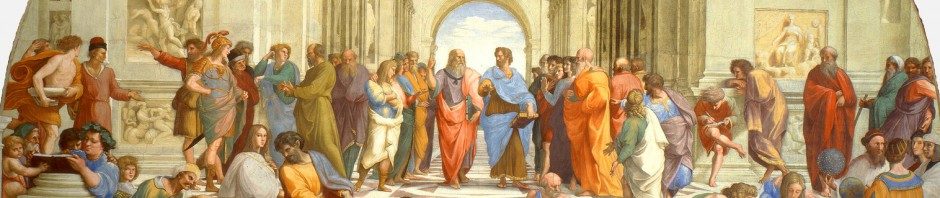

The periodic transformation of Private International Law invariably prompts questions regarding the existence of a public international organization endowed with the authority to promulgate regulations and ensure their adherence and implementation. The safeguarding of interests that transcend those of individual States was addressed through the establishment of the League of Nations and subsequently the United Nations. These entities mandated States to relinquish their right to engage in war and to uphold the fundamental rights delineated in the 1948 Universal Declaration of Human Rights. The concept of sovereign power as a market regulator diminished and ultimately vanished with the emergence of the European Community, which redefined national States from absolute sovereigns to associative sovereigns, thereby rendering the notion of sovereignty fluid and incompatible with rigid definitions.

The ascendancy of the concept of “supranationality” signifies a departure from the traditional notion of sovereignty, the decline of the conventional State model, and a redefinition of power, which is no longer confined to the territory under the sovereignty of individual States. By ceding portions of their power to supranational bodies and institutions, national States adopt a supplementary role, becoming components of a system characterized by layered sovereignties and integral to a global interaction framework where sovereignty is systematically dispersed and subject to the compelled abdication of increasing segments of authority.

Globalization is typified by the progressive self-regulation of the economy, asserting its independence from the State, which assumes an increasingly peripheral role. National sovereignty wanes as economic and social interactions become de-territorialized, accentuating the importance of transnational economic regulation and the centralization of global political decision-making. The market, evolving into an independent legal regime along with the lex mercatoria, reshapes global economic regulations, underscoring the adaptability and flexibility of transnational economic law.

Transnational corporations, unshackled from territorial constraints, represent a novel form of global sovereignty, orchestrating their operations according to the demands of the global market without specific allegiance to any State. This evolution signifies a pivotal shift in the State’s role in favour of market dynamics propelled by transnational enterprises, which emerge as central pillars of the global economy, influencing economies and markets through their investment decisions.

Within the European Union, the interplay between interdependence and the collision of sovereignties is especially salient, given its distinctive historical, cultural, and institutional attributes. European integration epitomizes a vital model for global cooperation. Nonetheless, the global financial crisis, epitomized by the sovereign debt and financial institutions crisis in Europe that commenced in 2008, has significantly impacted this integration process. Economic adversities may foster divergent dynamics: they may necessitate expanded collaboration, yet simultaneously encourage trends towards protectionism, hostility, and the resurgence of nationalism and populism. However, not all conflicts or procedural delays within international or supranational decision-making frameworks yield negative outcomes. In certain instances, the mutual dependency between States and communal entities may even intensify. The Economic and Monetary Union, for example, rests on four principal strategic pillars for the future: 1) harmonization of financial and banking oversight systems; 2) implementation of coordinated or unified strategies for taxation, joint budget management, and public debt mutualization; 3) centralization of directives for economic policy and national structural reforms; 4) introduction of new frameworks and structures to enhance the democratic legitimacy of EU and Eurozone central authorities. Nevertheless, the path toward European integration can be fraught with conflicts, where central powers, although legitimized and shaped by the national interests of dominant nations, tend to constrain national sovereignties, with various implications for community identity. At times, the integration process may appear uncertain, hesitant, and at times inefficient, influenced also by actors representing specific interests, potentially in conflict with collective ones. The ideal objective would be to channel sovereign tensions into a catalyst for augmented cooperation.